Inventory Valuation for Restaurants: What’s the Best Food Costing Method for You?

Inventory valuation for restaurants is key to calculating your net profit. Read about how this applies to your restaurant’s profitability.

If you had to sell your restaurant today, would you know how much it's worth? A lot of a restaurant’s value is tied up in the value of its inventory. Inventory valuation is a major factor in calculating your net profit, as well.But how do you determine the value of your inventory, and how does it apply to your restaurant’s profitability? In this article we’ll explore the various methods of inventory valuation and how they affect your bottom line. And we’ll take a close look at food costing methods for various restaurant scenarios.

Five Profit-Impacting Trends Shaping the Restaurant Industry in 2023

🔓 Unlock the secrets to restaurant success with actionable strategies for optimizing operations, maximizing profits, and building a loyal customer base.

What Is Inventory Valuation?

Restaurant inventory valuation refers to the process of assigning monetary value to a company’s products. In a restaurant’s case, that, of course, means its menu items.

Typically, when we’re talking about inventory, we’re referring to stocktake, all of the food and ingredients in your storerooms, fridges and freezers. When it comes to inventory valuation, however, everything that goes into making a menu item is taken into account.

Food Cost

The first and most obvious component of your inventory is your food cost. What’s sitting on your shelves, and in your fridges and freezers?

This number should include any stocktake that’s thrown away in the cooking process, such as burnt food or spilled ingredients.

Getting a monetary value for each ingredient is easy if you have an inventory management software solution. The value of each item should already be stored within your system.

Cost of Direct Materials

What other materials are needed to make each dish? That number includes the average cost of kitchen equipment, cooking utensils, and plates.

Overhead Cost

Overhead accounts for utilities, technology, advertising, marketing, and other general expenses that keep your restaurant running. It also accounts for labor costs.

Take a look at your staff management software to understand the cost of your BoH and FoH labor to get menu items from kitchen to table.

Delivery Cost

If you offer delivery service, the cost of food prep for travel, delivery drivers, and gas should be factored into your inventory valuation, as well.

Food Costing Methods

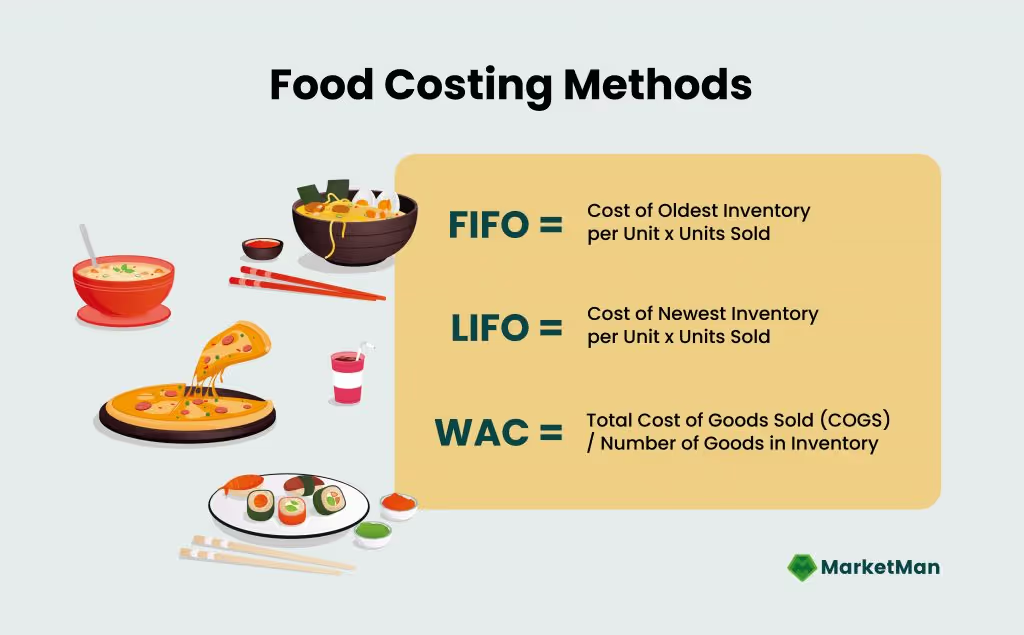

To determine your inventory value, you first and foremost have to know the cost and value of your food inventory. There are a few different ways to determine inventory value. The best one for your restaurant will depend on the kind of inventory you carry and your business model.

FIFO

With the FIFO method, ingredients with the latest expiration date are used first. And while the rising cost of food means a restaurant is spending more, the financial burden is minimized because there is less food waste.

The formula for the FIFO method looks like this:

Cost of Oldest Inventory per Unit x Units Sold

So, if your restaurant bought 10 lbs of blueberries for $.060 per lb, on Monday and then bought another 10lbs on Friday at $0.65 per lb, you would calculate your valuation using the oldest price up to the point the price changed.

LIFO

The last-in-first-out method isn’t quite as popular with restaurants, unless they have a large stock of non-perishable goods. (and how often does that happen?) With LIFO, the theory is that older items cost less to purchase, so using the more expensive newer items and valuing them at cost offsets those expenses.

Calculating LIFO is simply a matter of tweaking the FIFO formula:

Cost of Newest Inventory per Unit x Units Sold

If you bought 20 jars of pickles at $2.00 per jar last month and the same amount at $2.50 per jar this month, you would work backward, using the more expensive price until the date the price went down.

WAC

The weighted average cost of inventory is determined by the total cost of goods sold (COGS) divided by the number of goods in inventory.

To figure out your inventory cost using WAC, take a look in your inventory software solution. Find the cost of each food or ingredient, and then divide it by the amount of that item in your inventory.

This gives you a more consistent value of your stocktake, rather than a value based on when the goods were purchased.

To calculate WAC, calculate the average cost of each item by dividing total cost for that category by the number of items you have in that category.

So, the weighted average cost for all the blueberries you have would be

(10 x 0.60) + (10 x 0.65) = $0.63

20

Inventory Replacement Cost

With this method, cost is assigned by the amount of money spent to replace items in your inventory. This number fluctuates frequently, depending on the market.

How Does Inventory Valuation Relate to Net Profit?

The food costing and valuation method you choose has a direct impact on your net profit. If you choose the FIFO method, for example, you will have a higher net income, because you’re selling the goods that cost you less money first, but you’re selling them at current market prices. On the other hand, that also gives you more taxable income.

That’s why some restaurants use the LIFO method. Their net profits are lower, but their taxable income. It does, however, increase your overhead costs for storage.

The Best Inventory Valuation Method for Your Restaurant

The FIFO, or first-in-first-out method, is the one most used by restaurants, particularly for those with a lot of perishable goods, or goods that move quickly. It allows them to reduce food waste and maximize the cost efficiency of their stocktake, which can offset those higher taxes we mentioned before.

LIFO is less popular, simply because it usually doesn’t suit restaurants’ business models. Not many restaurants use more non-perishable items vs perishable ones.

The WAC method, meanwhile, may be a good fit for restaurants that deal with a consistent, high-volume inventory. It allows you to get a clear picture of each item category without spending time figuring out the cost of each item while taking current market value into consideration.

No matter your inventory valuation method, the first place to start is knowing your inventory inside and out. How much does each item cost and what are the costs associated with each menu item? How much of each item do you sell and how much sitting inventory do you have?

All of that can be answered by using a software solution that not only manages inventory, but connects with your POS, staff management, and other software solutions. That will make inventory valuation more efficient and more accurate for your business.

MarketMan's restaurant management software gives you the power to automate inventory tasks, control food costs, and optimize back-of-house operations. It eliminates manual work and offers restaurateurs advanced insights for strategic decision-making. Boost your efficiency, reduce waste, and take the stress out of restaurant inventory management. Book a demo today to discover how MarketMan can transform your restaurant!

Author

Contributors

If you have any questions or need help, feel free to reach out

Don't miss out on maximizing your restaurant's profits! Calculate your ROI with MarketMan

Join over 18,000 restaurants and get the hottest restaurant tips delivered to your inbox

You may also be interested in

Ready to get started?

Talk to a restaurant expert today and learn how MarketMan can help your business