A Path to Increased Profitability: Lowering Cost of Goods Sold

Explore actionable insights into variable and fixed costs, prime cost ratio, and the latest technology solutions that can significantly improve your restaurant's profitability.

MarketMan customer The Other Bird, a Canadian hospitality group, got serious about optimizing inventory management and implemented strategies to lower Cost of Goods Sold (COGS) by 10%, adding tens of thousands of dollars to their annual bottom line.

How did they go about it?

Strategies to Lower COGS: Know Your Costs

Successful industry veterans know their food costs. To be successful, and to know the path to profitability, you need to be intimately aware of the accounting components of restaurant profitability.

Six Foolproof Restaurant Cost Management Techniques

Maximize your restaurant's profitability with this essential eBook. 📈 Learn foolproof cost management techniques and unlock proven strategies for supplier negotiations and brand loyalty. 👩🍳🤝

Let’s take a quick refresher course on standard restaurant costs.

Variable Costs are those that are based on creating the dishes and beverages that are delivered to customers. Ingredients, beverages, packaging, and cleaning supplies are just a few examples of variable costs. These costs can vary greatly over even a short period and can affect short-term profitability.

Fixed Costs are just that – more predictable costs with less change over time. Leases, payment processing, utilities, taxes, license fees, and employee compensation and benefits are examples of fixed costs. Unlike variable costs, fixed costs are difficult to lower with any agility.

Food Cost and Cost of Goods Sold (COGS) are related but not the same thing.

Food Cost is the cost of the food items used to prepare a menu item. Food cost includes the cost of ingredients and any other costs associated with the preparation and presentation of a dish like garnishes and staff labor costs directly associated with food preparation. Food cost is often expressed as a percentage of the menu price of the menu item.

COGS includes all costs associated with producing and delivering the menu item to a customer. In a restaurant, COGS would include the cost of not only food items, but also any other items that are directly related to the production of a dish, such as beverages, cooking equipment, packaging, kitchen supplies, cleaning supplies, and similar.

The average COGS for a successful restaurant can vary widely depending on factors such as the restaurant type, location, menu prices, and operational efficiency. But recent industry benchmarks have reported a target COGS of 28-35% of total revenue for a successful restaurant.

COGS is important to calculate Prime Cost. The equation for prime cost is calculated by adding COGS and labor cost.

Both prime cost and COGS are important in the calculation of Prime Cost Ratio. The prime cost ratio is a measure of a restaurant's overall profitability and is calculated by adding together the cost of goods sold (COGS) and total labor costs, then dividing that sum by total revenue for a time period (usually a week or month.). Like food costs, the prime cost ratio can vary widely depending on the type of restaurant, location, menu prices, and staffing levels.

According to industry benchmarks, the average prime cost ratio for restaurants is around 60-65%. This means that the combined cost of goods sold and labor costs make up 60-65% of total revenue for a typical restaurant. Note: this average can vary significantly depending on the type of restaurant, the location’s cost of living, and variables in a restaurant's operations.

It's also worth noting that while the prime cost ratio is a useful profitability benchmark, it’s not the only measure of success. Factors like customer satisfaction, repeat business, and revenue growth may be just as important.

Profitability starts with visibility. Discover how Spoons used MarketMan to gain control and grow margins.

Accurately Calculating Restaurant Costs Can Be Complex

Restaurant businesses like The Other Bird can lower the cost of goods sold by using various strategies, but the most impactful strategy has been implementing technologies that replace profit-draining manual, paper-based processes that directly help reduce food waste and spoilage, help effectively manage vendors and suppliers, and lessen the daily workload of staff and management.

An effective strategy to increase profitability – to get to that prime cost ratio of 60-65% where successful restaurants want to be – requires accurate and timely COGS analysis, and usually requires some automation using labor-saving technologies that can cut hours off the manual tasks in a shift for restaurant staff.

How to Start Lowering COGS

Every experienced restaurant manager understands the importance of food costs, but the challenge always has been how to quickly and accurately calculate them. Taking inventory is time-consuming and costly and is often done by experienced, higher-salary managers.

But knowing a long-term comparison of COGS over time is vitally important to start to know your best path to increased profitability.

What is a solid food cost percentage? Food cost percentage is the portion of your overall sales that you spend on food and ingredients. Managers want this number to be as low as possible. The higher your food cost, the more difficult it will be to pay for other expenses like overhead and staffing.

Historically, the optimal COGS is between 20 and 30%. As long as the quality is not sacrificed and the customer experience is not degraded, use this range as your benchmark for your COGS.

Why Care About Cost of Goods Sold?

Profitability in the restaurant business is primary. Menu profitability is the foundation of a successful restaurant. A well-engineered menu is always profitable and can instill a consistent customer experience that keeps customers coming back.

Variable costs involving menu pricing and ingredient costs largely determine a high percentage of a restaurant’s profitability. As mentioned, variable costs can be much easier to manipulate to respond to profit challenges than fixed costs.

But there’s a twist: the more accurate your cost of goods sold calculations are, the better you can engineer and price a profitable menu.

The Benefits of Accurate and Efficient Cost of Goods Calculation

1. Gain Control Over Profitability

Lowering your COGS allows you to keep more of the revenue coming into your restaurant.

Here’s an example:

You sell 100 gourmet burgers a week for $15 each. Your food cost for the burgers is $6 (40% food cost percentage).

If you can lower your food cost by 15% (down to $5.10/burger), you’re looking at an additional $4,680 in revenue by the end of the year.

$6.00 - $5.10= $0.90 additional profit per burger

$0.90 x 100 burgers a week = $900

$900 in extra profit per week x 52 weeks = $4,680

You can see how reducing the cost of goods for all menu items will quickly result in an improvement in profitability.

2. Engineer a Menu That’s Easier To Price for Profitability

Without calculating the exact ingredient cost for each item on the menu, how do you know how much to charge so you’re making a profit?

A simple cost of goods calculation could show you that a menu ingredient has an incredibly high food cost. With this information, you can decide whether to raise prices accordingly to keep your profit margin, modify the recipe, or even replace it with a more profitable menu item.

By accurately analyzing your cost of goods, you can maximize your profits or use data to understand if menu items are eating into your overall profitability.

3. Good COGS Analysis Delivers a Better Understanding of Ingredient Costs

When you know your cost of goods, you know how ingredient choices are affecting your menu profitability. If there’s a sudden spike in the cost of a highly seasonal ingredient, you can quickly adjust that recipe’s price or remove it completely.

Another option is to substitute an expensive menu item with a less expensive option. For example, if the price of a certain spice or ingredient gets too high and makes a dish unprofitable, you can substitute it for a more affordable option while keeping the dish relatively the same.

4. Optimize Your Menu Promotion for Profitability

A simple strategy to increase profits is often produced from how you present your dishes on the menu, as well as how staff answer menu questions from customers. When a restaurant menu item is highlighted, it attracts the customer’s attention. The wait staff answering customer questions about what’s good on the menu is another opportunity to push profitable, customer-satisfying dishes as well. Once you know your food costs, you can more easily coach the wait staff on which menu items to promote during interactions with customers.

The Value of Cost of Goods Sold Automation

Calculating COGS involves adding up the cost of all the ingredients and materials used to prepare the dishes served during a period – day, week, or month.

A standard method to calculate COGS typically involves:

- Determine the period for which you want to calculate COGS. This could be a day, a week, a month, or any other period that makes sense.

- Determine the beginning inventory by taking stock of all the ingredients you have at the beginning of the period. Typically this includes the count of ingredients in the pantry, bar, refrigerator, and freezer.

- Calculate the cost of all ingredients and materials you purchased during the measured period. This includes invoices from vendors/suppliers for food, beverages, and supplies.

- Calculate the cost of all ingredients and materials you purchased during the measured period. This includes invoices from vendors/suppliers for food, beverages, and supplies.

- Calculate COGS by subtracting the cost of the ending inventory from the sum of the beginning inventory and purchases. This gives you the total cost of goods sold for the period. COGS formula: Beginning inventory + Purchases - Ending inventory = Cost of Goods Sold

It's important to note that not all costs associated with running a restaurant are included in the COGS calculation. COGS only includes the cost of the ingredients and materials used to prepare the dishes served to customers. Other costs such as labor, rent, utilities, and marketing expenses are NOT included in COGS.

MarketMan Can Help Cost-Effectively Lower GOGS

What is so valuable about accurate COGS analysis over time?

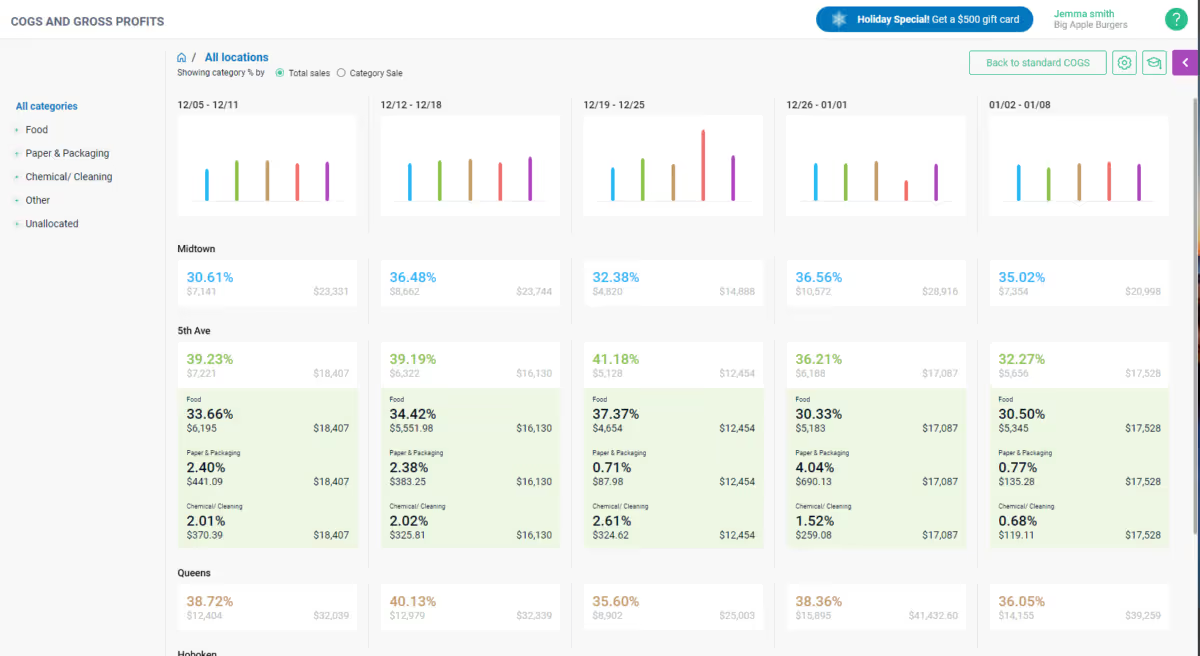

With MarketMan's ‘COGS Over Time’ feature, restaurants can quickly create reports with a few clicks to identify where managers can intervene to identify increases in COGS and then quickly remedy those issues.

The ‘COGS Over Time’ report is a comparative dashboard view of COGS across multiple periods. Once set up, and with only a few clicks, you can easily drill down into COGS or even examine specific categories and items – and see how they trend over time.

This feature offers real business intelligence into COGS.

Now that we’ve outlined how to calculate COGS, let's review ways to lower the cost of goods sold.

Lower Your Cost of Goods Sold and Increase Your Profitability

Before you can begin lowering food costs, you first need to identify your cost challenges. Are cost of goods sold high because of waste, spoilage, or theft? Here are common practices that restaurants who are masters of inventory management apply to lower the cost of goods sold:

1. Implement Rigid Kitchen Practices

You created and analyzed each of your recipes with a specific quantity of ingredients in mind, both to create certain flavor results and to stay within budget for that menu item. Without food scales and established kitchen practices, you can’t know if your line cooks are using the correct amount of each ingredient in your dishes. If your kitchen staff hasn’t been trained to measure ingredients accurately, then the portion sizes of your meals won’t be consistent. A cook that uses an extra ounce (one ounce!) of sauce per pasta dish will increase your food cost percentage and cut into your profits. Require your staff to use a kitchen scale for every dish they prepare, and train them from the start about reducing waste.

2. Keep An Eye On Waste

Another thing you can do is keep an eye on plates as they come back to the kitchen. If customers request to-go boxes on a regular basis or leave a significant portion of food on their plates, you have a food cost savings opportunity on your hands. If people are consistently taking home some of your shepherd’s pie, you can cut back on the portion size and reduce your food cost in the process.

3. Improve Inventory Management

Inventory management is essential to the success of any restaurant. You should always know the cost of ingredients and track the number of ingredients in each menu item. The key benefit of effective inventory management is calculating exactly how much inventory you need – and avoiding food waste, spoilage, and the customer satisfaction issues involved with under-ordering inventory and 86ing profitable dishes mid-shift.

By tracking your inventory consistently, you’ll be able to hone in on exact numbers and optimize your vendor and supplier orders. Industry studies have reported that 4-10% of the restaurant inventory doesn’t end up being sold to customers. That’s a significant hit to profitability. Minimizing food waste is one of the easiest ways to lower Cost of Goods Sold and increase profitability.

Accurate inventory tracking is also the best way to determine the profitability of your menu items. You need to have accurate and up-to-date data that breaks down each of your menu items in real-time. Fast-acting price changes from suppliers, in these times of food inflation, will negatively affect your bottom line. If your overall food cost percentage is within acceptable limits but your revenue isn’t reflecting this fact, you may have problem ingredients on your hands. This is why calculating the food cost percentage per each menu item is critical. It can reveal which dishes aren’t turning a profit on a daily basis.

Efficient inventory management can also help identify theft. If the starting and ending inventory don’t align with ingredient purchases and meals sold, you know you may have a theft issue. While minor discrepancies may be the result of a waste issue, any significant variances are worth investigating.

4. Negotiate With Your Suppliers

Negotiating better prices with your suppliers can improve your profit margin. Are there any ingredients that I can buy in bulk to bring down the price? Can I purchase more items from one supplier to get a bulk discount? Can I efficiently manage more suppliers and improve my supply chain? Can I get a discount for signing on to a long-term contract? Have I researched market prices for my inventory items and found the best deal?

There’s often plenty of wiggle room in supplier negotiations. The more ingredients you’re purchasing, the more willing a supplier will be to accommodate your request.

5. Optimize Your Menu

Once you’ve done all your food costing and learned the profitability of menu items, you can start to optimize the menu with an eye on profitability.

6. Evolve Your Technology Stack

You may have found a Point-of-Sale (POS) solution that has drastically helped your staff handle more customers with greater efficiency. Restaurant technology is evolving at a rapid pace today. Software as a Service (SaaS) and cloud-based apps are replacing outmoded manual workflows in restaurants, allowing managers to handle a hectic and possibly profitable shift with less staff – and allowing that staff to focus on customer satisfaction and other revenue-generating tasks. For example, automating inventory management helps keep track of ingredient costs and reduce waste, while a POS system can streamline ordering and payment processes, and handle more customers with the same staff level.

To Lower COGS You Need Accurate Data

COGS is key to a restaurant’s success. Knowing your food cost percentage can help you build up your restaurant in a more calculated way and ensure that it remains profitable. Before you implement any of these suggestions, establish goals for what you’re trying to achieve.

Are you looking to reduce food cost percentage by 5% for the year? Reduce it by .5% per month? That’s a goal you can measure against as you implement different strategies. But to do this you need the data to see trends.

Implementing strategies to lower Cost of Goods Sold is a great start, but these efforts are worthless without getting accurate data and measuring the results.

Automating Inventory Management for Increased Profitability with MarketMan

Tracking your cost of goods sold can be enormously time-consuming — not to mention an organizational nightmare. Storing and interpreting receipts, spreadsheets, and invoices gives most restaurant managers a headache.

MarketMan can help. MarketMan is an easy-to-use cloud-based application designed to help restaurants manage their inventory, accurately track food costs, efficiently manage vendors and suppliers, and increase profitability across the board.

On average, restaurants lower their cost of goods sold by 5% with MarketMan. This 5% is added directly to our customers’ bottom lines. With MarketMan, you gain accurate analytics in real-time. You can input all of your recipes for dynamic recipe costing, track ingredient prices, set alerts when menu items become unprofitable, and always know the status of your inventory.

MarketMan gives you all the tools you need to accurately calculate your cost of goods sold and eliminates messy paper receipts and spreadsheets. You can automate inventory management and leave behind slow and labor-intensive manual inventory management tasks. Save time, boost profitability, and make your back-of-the-house operations a breeze with MarketMan.

Check out our quick interactive demo and learn how MarketMan can:

- Reduce COGS

- Easily Integrate with your POS

- Document and minimize food waste and spoilage

- Build profit-enhancing recipes to maximize margins

- Accelerate inventory counting, and

- Generate powerful reports to analyze profitability and actual vs theoretical usage

MarketMan's restaurant inventory management software simplifies back-of-house processes, from inventory management to food cost control. Automate daily tasks, reduce waste, and gain actionable insights to boost your restaurant's profitability. Take the guesswork out of operations and focus on delivering exceptional experiences. Book a demo now to see how MarketMan can transform your restaurant operations!

Author

Contributors

If you have any questions or need help, feel free to reach out

Don't miss out on maximizing your restaurant's profits! Calculate your ROI with MarketMan

Join over 18,000 restaurants and get the hottest restaurant tips delivered to your inbox

You may also be interested in

Ready to get started?

Talk to a restaurant expert today and learn how MarketMan can help your business